Arkady and Boris Rotenberg – judo partners of the Russian president – used a type of company that was not required to identify its real owners.

Ministers have acknowledged concerns that these companies, known as English Limited Partnerships (ELPs), have also been abused by criminals.

A joint investigation by the BBC and Finance Uncovered has discovered evidence linking a number of ELPs to fraud, terrorism and money laundering.

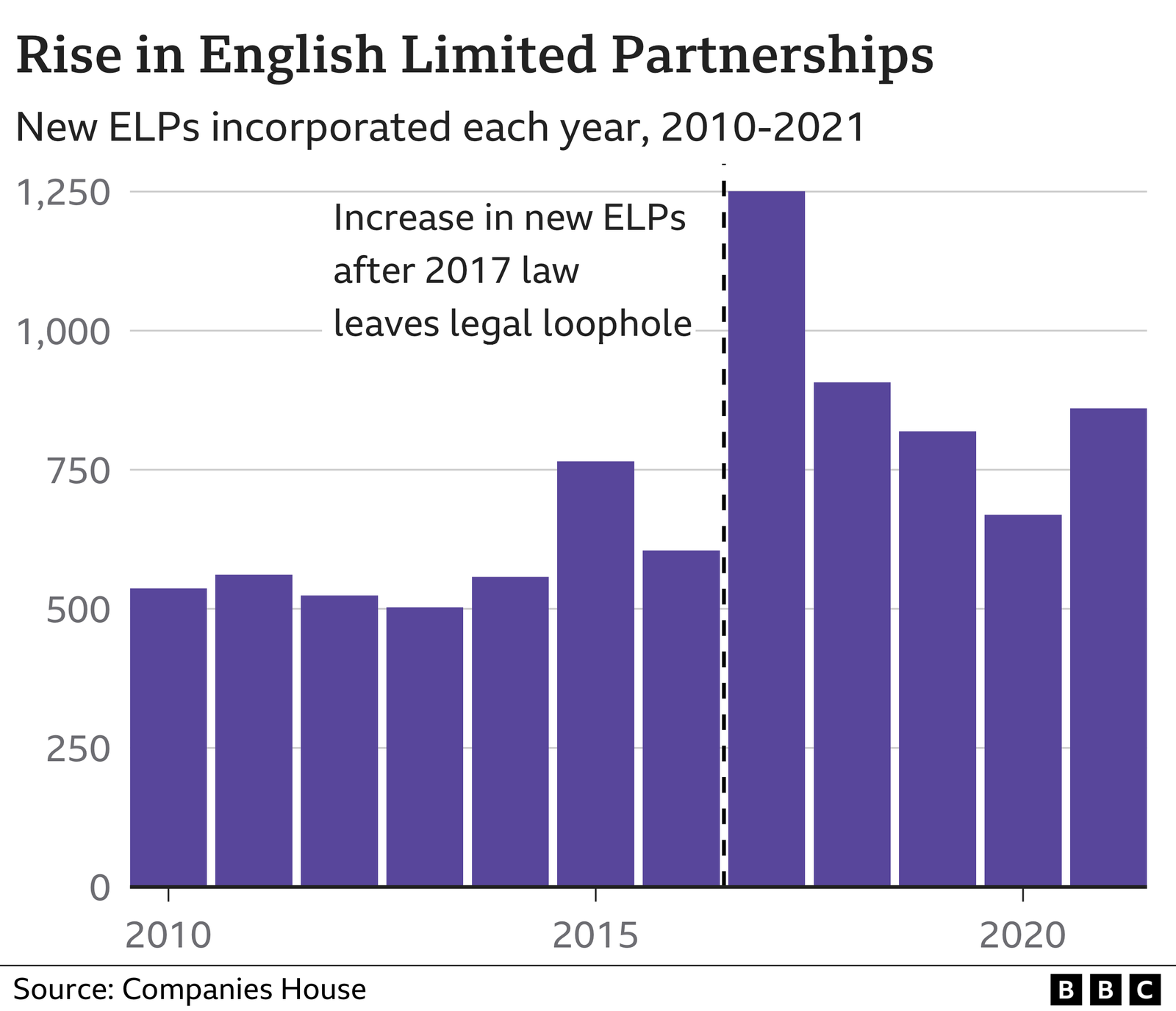

In 2016 and 2017, the government introduced measures that forced almost all UK companies to identify their real owners. ELPs were not covered by these new transparency laws.

Since then, more than 4,500 of them have been set up.

The BBC has worked with Finance Uncovered to analyse leaked documents and thousands of company records that show how ELPs have become a route to dodge anti-money laundering laws requiring the real owners, or persons of significant control, of UK companies to be disclosed.

ELPs are legitimately used in real estate, investment and pension funds – they have tax advantages, for example, and the amount investors risk is limited.

Unlike most companies, ELPs do not have a separate legal identity. The government says that means they cannot own assets, do not have a beneficial owner, and cannot legally open bank accounts in their own right.

But our investigation has found documents identifying beneficial owners of ELPs, and evidence of their use to open bank accounts and to facilitate financial crime. Hoka Running Shoes According to Graham Barrow, an expert in financial crime, they are also “vulnerable to misuse” because of how little information about their activity they are required to make public.

Our data shows the number of new ELPs being set up has gone up by 53% since 2017.

“I wish I could be shocked about the scale of this, but I’m absolutely not. I’m just depressed and frustrated,” says Helena Wood, head of the UK Economic Crime Programme at the Royal United Services Institute.

The investigation also reveals:

- Leaked documents show ELPs were marketed as an “alternative solution” to avoid transparency laws

- Just five companies, known as formation agencies, have been responsible for 1,500 ELPs, with hundreds listed at registered addresses including one above a burrito bar in central London

- A 71-year-old Swiss ceramic artist used in official paperwork to hide the real owners of UK companies was a signatory for more than 160 ELPs

- FBI agents investigating the Boston marathon bombing probed an ELP registered at an address currently home to a barber shop in Bristol.

More than 4,500 ELPs have been created in the five years since the new transparency laws came into effect. In the five years to 2017, 2,950 were set up.

We have established that among those to take advantage of the secrecy of ELPs are members of President Putin’s inner circle.

IMAGE SOURCE,GETTY IMAGES

IMAGE SOURCE,GETTY IMAGESThese are brothers Arkady and Boris Rotenberg who were the subject of an investigation by a US Senate committee in 2020. It said they had exploited a global web of shell companies to evade US sanctions imposed following the annexation of Crimea in 2014. These companies were used to buy millions of dollars worth of art.

One of these companies was an ELP. Sinara Company LP was set up in January 2017 and listed its principal place of business at an address a stone’s throw from London’s Oxford Circus.

It claimed to be involved in “tourism and ticketing services”.

Between July 2017 and June 2018, it sent “14 wire transfers in $9,500 increments totalling $133,000” (£109,000) to an art adviser who the Senate report said “facilitated purchases for the Rotenbergs”.

Under UK law, there is no requirement to disclose who was behind Sinara, which was dissolved in 2019.

“It’s a scandal that people like the Rotenbergs who have been sanctioned in America for years have still been able to use British corporate structures to bring their money out of Russia through these structures and then spend it at will,” says Labour MP Dame Margaret Hodge, who chairs a parliamentary group on tax and corruption.

The BBC tried to contact the Rotenbergs, but have not received a response.

Most limited partnerships are set up by so-called company formation agents – or presenters – who provide a registered address and administrative support.

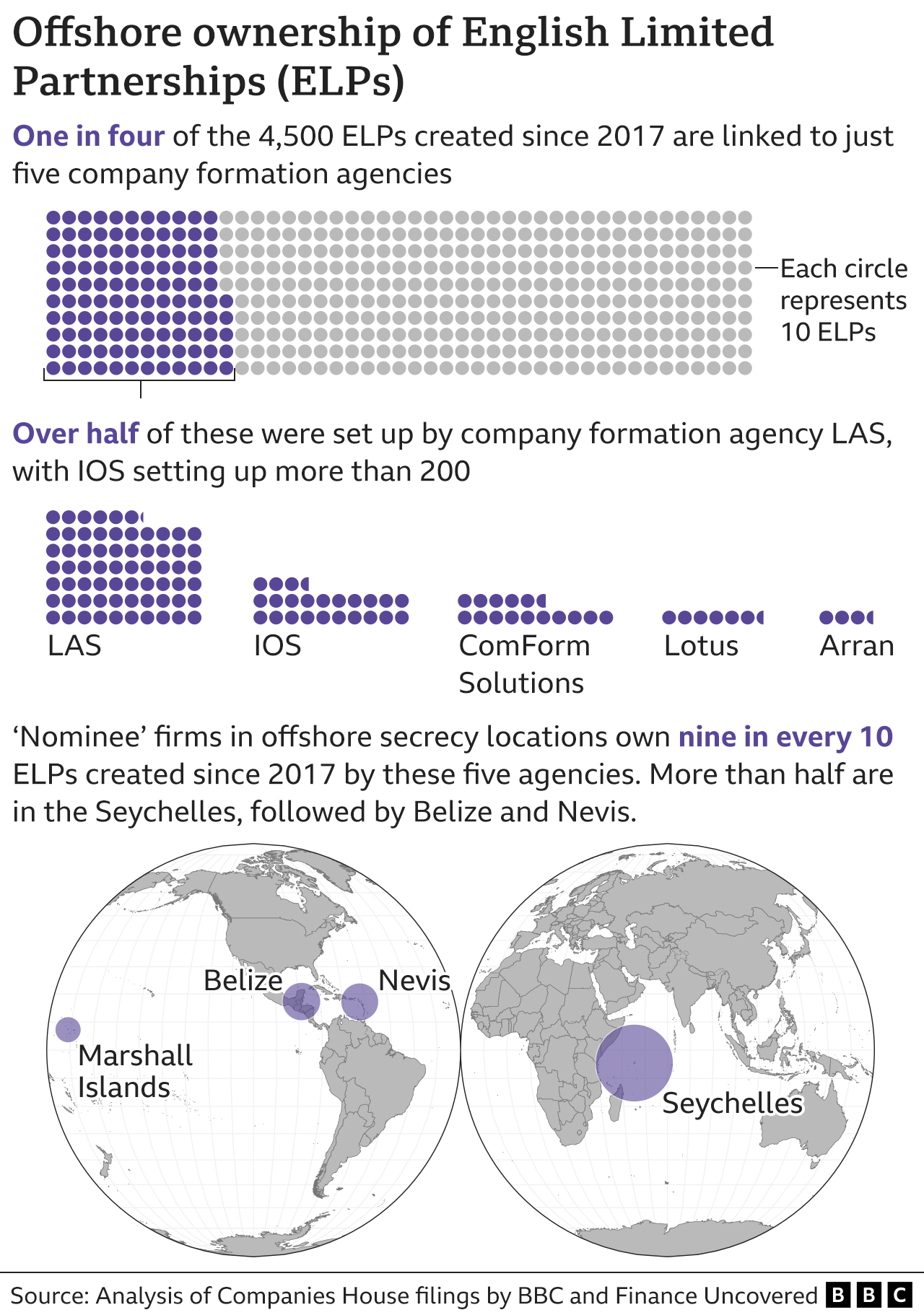

The BBC and Finance Uncovered found that of the 4,500 ELPs formed since 2017, one in four were created by just five UK-based agencies.

These agencies have track records in creating Oofos Outlet anonymous UK companies for clients in Eastern Europe and the former Soviet Union. Some of those companies they incorporated have also been linked to financial crimes including money laundering.

Corporate records show the most prolific of these agencies is LAS, run by Elena Dovzhik, an Anglo-Russian accountant, and her Latvian business partner Ineta Utināne. The UK-based businesswomen have made millions from LAS, the activities of which include forming and administering hundreds of anonymous British companies for clients based across Eastern Europe and Central Asia.

A number of companies associated with LAS have subsequently been involved in crime. One, Always Efficient LLP, a firm registered to a London address provided by LAS, was found to be behind BTC-e, the largest Russian-language bitcoin exchange. The exchange was shut down in 2017 by the US Justice Department in relation to allegations of money laundering.

And last year the fazze.com website, which used a LAS contact address, was alleged to have run a Russian-coordinated vaccine disinformation campaign, spreading claims that the AstraZeneca vaccine would turn recipients into chimpanzees.

LAS told the BBC that they “terminated” their services to Always Efficient LLP “in 2017 due to their breach of our Terms & Conditions”.

In relation to fazze.com, LAS say: “This could be an illegal and unauthorised use of our address services as we do not hold exact or similar details in our historic database.”

LAS was also responsible for setting up huge numbers of another type of UK company called Scottish Limited Partnerships (SLPs). A 2017 investigation by Bellingcat, found that LAS was the “single most prolific presenter of SLPs between 2015 and 2017”.

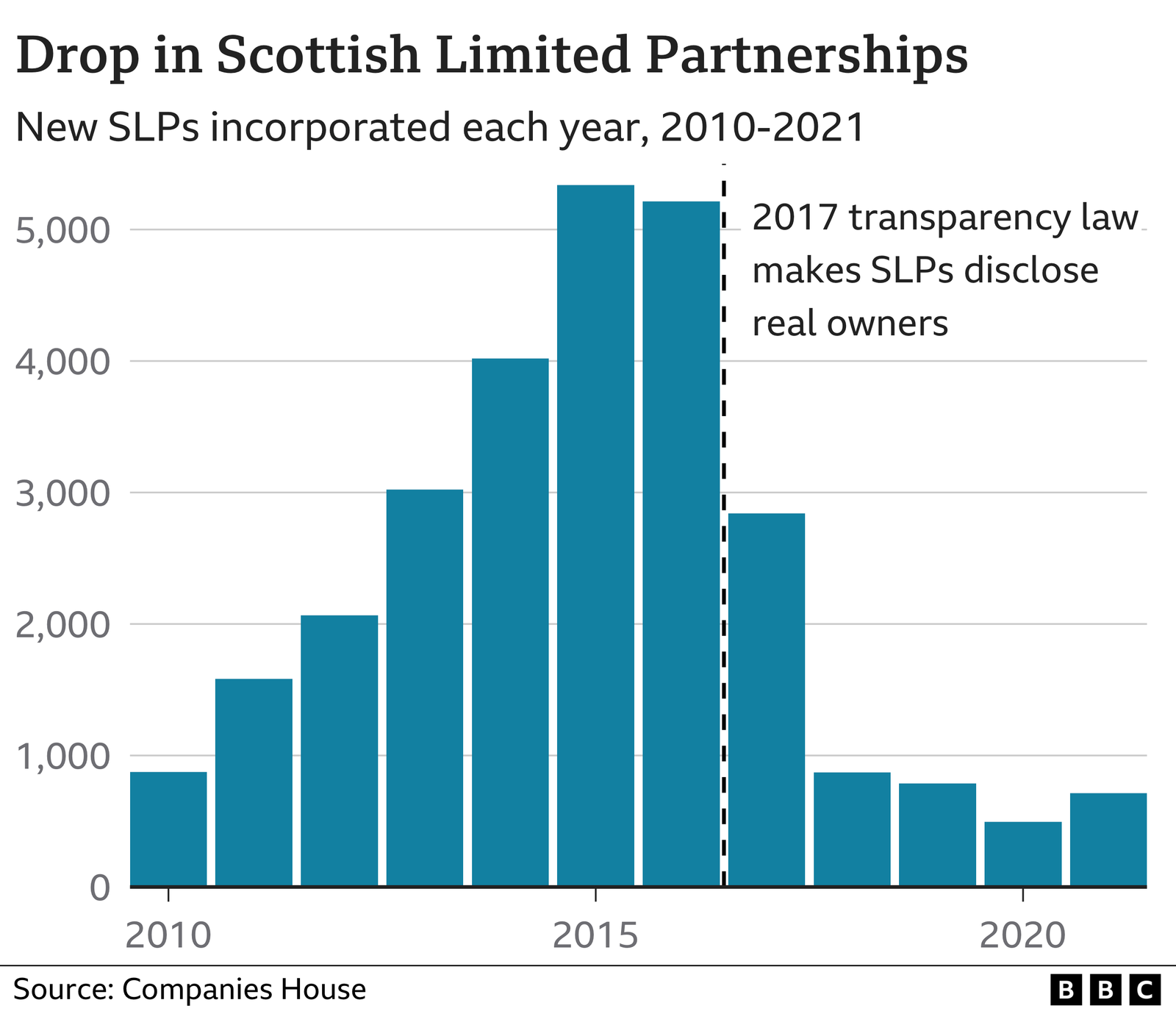

SLPs at the time did not have to disclose their real owners. But after they were repeatedly linked to major international money laundering scandals, the UK government changed the law so they had to provide information about those who ultimately owned or controlled them. Almost immediately the number of registrations fell by almost half.

After this change in the law around SLPs, leaked documents seen by the BBC show LAS switched its attention to ELPs.

In an emailed update to clients dated 18 May 2017, under the heading “Alternative Solutions”, LAS proposed ELPs as, “a way out and as a substitute for Scottish Partnerships”.

The document, discovered in the Pandora Papers, a data leak obtained by the International Consortium of Investigative Journalists (ICIJ), continued: “For the time being, the privileges of this type of partnership are that they are not and will not be subject to the laws of the disclosure of information about the controlling persons.”

Now our investigation has discovered the involvement of a number of ELPs associated with LAS in alleged criminal activity.

They include companies, owned by ELP Donnea Business LP, which have been accused of evading tax in Ukraine and another ELP called Cosalima Trade LP controlled by a Russian businessman wanted by the authorities in Russia in relation to a £5m fraud.

LAS boss Elena Dovzhik said: “We are aware that many years ago we filed registration documents for some companies that eventually were accused in unlawful activities, but such information was not available to us prior (to) registration.”

“We (have) never been involved in any business Hey Dudes Shoes activities of our former clients and only assisted our corporate clients with their company’s formation process, mail-forwarding services, (and) statutory filings.

“We never supported any kind of fraud or illegal activities.”

She explained that her firm had “enhanced due diligence for all international clients” and “if any of our clients was ever reported to us as being under suspicion of being involved in unlawful activities… services were terminated with immediate effect”.

Both Donnea Business LP and Cosalima Trade LP were registered to addresses provided by LAS in London.

Cosalima Trade LP was registered at the second floor of 6 Market Place, in premises above an unrelated burrito bar in Fitzrovia, central London.

This address is home to around 800 active companies. It’s one of the most frequently used addresses for ELPs in the country. Over the past five years, more than 240 ELPs have been registered here.

A scrap of paper inserted into a button on the intercom lists just one company at the address – 1000 Apostilles Ltd, which is owned by LAS’s Ineta Utināne.

LAS says its “lease for 6 Market Place expired during this year”.

Another popular address for ELPs is not in London but in Bristol.

1 Straits Parade in the Fishponds area of the city is now a Turkish barber shop.

It has also been an address used by Arran, another formation agent, to set up UK companies including 197 ELPs.

Companies registered at the address have been linked to bribery, fraud and other financial crimes.

Our investigation has discovered that Rivelham LP, an ELP that was registered there in 2013, was also flagged during the FBI inquiry into the 2013 Boston Marathon bombing in the US.

Rivelham LP was identified in suspicious activity reports produced by Deutsche Bank and handed to federal agents as part of the investigation into financial transactions associated with those responsible for the bombing.

The reports, from a leak of suspicious activity reports filed with the US Treasury known as the FinCEN Files, do not identify who owned the ELP, but they record its involvement in 116 suspicious transactions totalling over $7.3m (£6m) in just one month between December 2012 and January 2013.

The BBC tried to contact the owners of Arran but received no response.

While addresses like 1 Straits Parade and 6 Market Place may indicate which formation agency has been involved with an ELP, they give little clue as to who is really behind them.

While names of the partners of the ELP can be found on paperwork submitted to Companies House, more often than not, the names will be of anonymous companies incorporated in countries including Belize and the Seychelles.

And even the real people signing paperwork for those companies are unlikely to be the true owners.

Typically they are nominee, or proxy signatories, paid to sign documents and they usually know nothing about what the company is doing.

One prolific proxy signatory is Ruth Neidhart, a 71-year-old from Switzerland who lives in Cyprus. She also works as a ceramic artist making porcelain dolls and jewellery, sometimes arranging pottery painting sessions for children’s birthday parties.

Our analysis of Company House filings has found since 2016, she has signed paperwork for more than 160 ELPs set up by the company formation agency she has worked for, IOS.

Mrs Neidhart did not respond to the BBC’s invitation to comment.

The investigation has also found one of the LAS’s most prolific nominees is Alexandru Terna, a Romanian national in his early 30s who lives in London. Mr Terna has signed Companies House paperwork for at least 306 ELPs created by LAS for clients.

Responding to written questions from the BBC, Mr Terna says his involvement was “arranged through LAS International” or a related company, “for and on behalf of owners of all individual companies, with whom we had trustee/nominee service agreements”.

He adds: “We have never been involved in the control or management of any company, mentioned in your letters.”

Campaigners say the BBC’s revelations about ELPs show that reform of the UK’s legal structures is long overdue.

“We’ve been warning the government about these problems with these opaque legal structures for years,” says Helena Wood of the Royal United Services Institute think tank.

“Transparency is the best disinfectant they say, and we need a bucket load of it with these English Limited Partnerships.”

The failure of successive British governments to shut down major loopholes in anti-money laundering laws stands in contrast to promises made by senior politicians.

As long ago as 2014 the government considered acting on ELPs but failed to do so. The following year the Prime Minister at the time, David Cameron, declared he was determined the UK would not become “a safe haven for corrupt money around the world”.

The government acknowledged in 2018 that there were risks posed by limited partnerships and “concerns that they are being abused by criminals following large-scale money laundering scandals”.

After the Russian invasion of Ukraine, Boris Johnson said he wanted to “open up the Matryoshka doll of Russian-owned companies” to reveal their true owners.

The government says it does not have any evidence of significant misuse of ELPs. A government spokesperson said: “The UK already has some of the strongest controls in the world to combat money laundering, and it’s vital that we continue to upgrade our governance to crack down on criminals abusing UK corporate entities.

“That’s why we are modernising the law governing UK Limited Partnerships through our forthcoming Economic Crime Bill which will tighten registration requirements and improve transparency – ensuring that only those acting within the law can remain on the UK register.”

But those proposals do not appear to include closing the ELP loophole requiring the disclosure of the real owners, or persons of significant control behind the companies.